Tuesday, February 26, 2013

The Ethics of Repudiation

Do you ever get the feeling that no one in the Washington power elite is willing to seriously deal with the major economic threat to future prosperity

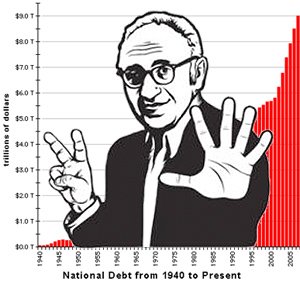

facing the United States today: mounting government debt and the associated deficits? The problem, as pointed out by Murray Rothbard over 20 years ago:

Do you ever get the feeling that no one in the Washington power elite is willing to seriously deal with the major economic threat to future prosperity

facing the United States today: mounting government debt and the associated deficits? The problem, as pointed out by Murray Rothbard over 20 years ago:

Deficits and a mounting debt, therefore, are a growing and intolerable burden on the society and economy, both because they raise the tax burden and increasingly drain resources from the productive to the parasitic, counterproductive, “public” sector. Moreover, whenever deficits are financed by expanding bank credit—in other words, by creating new money—matters become still worse, since credit inflation creates permanent and rising price inflation as well as waves of boom-bust “business cycles.”

In 1992, when Rothbard wrote the above, the US debt was approaching $4 trillion (now nearing $17 trillion) and Federal Reserve policy was relatively benign compared to the current quantitative easing, which is effectively monetizing a significant portion of newly created government debt. The “peace dividend” from the end of the Cold War and the false prosperity from two Fed-created economic booms made the problem appear less urgent and allowed politicians to kick the can down the road. A solution is now urgent, but not likely. David Henderson’s “Must Default Be Avoided at All Costs?” is a great place to start in order to reinvigorate a serious discussion on a moral approach to shrinking the size of the federal government down to a less destructive level.

Henderson wrote,

Bruce Bartlett, in The Benefit and the Burden, his book about taxes, writes that default “would constitute a grossly immoral theft of trillions of dollars from those who loaned money to the federal government in good faith.” In my review of his book, I commented, “Really? It’s worse to default on creditors who took a risk than to forcibly take money from taxpayers who have no choice?” [emphasis added]

Henderson sees default as likely to occur eventually and, given current trends and other alternatives, the more moral alternative. Jason J. Fichtner and Veronique de Rugy make a case that “Default must be avoided at all costs and should not be an option on the table” ("The Debt Ceiling: Assets Available to Prevent Default," January 25, 2013). But Henderson disagrees:

I’m unconvinced. The U.S. government has dug itself a deep hole. Commitments that it has made to various people must be broken. There is no plausible way, for example, that the U.S. government will be able, 20 years from now, to pay for all the Medicare, Medicaid, and Social Security benefits that it has committed to pay. One such commitment to consider breaking is the commitment to pay the debt. [emphasis added]

For a sustained case in favor of default, Henderson recommends Jeffrey R. Hummel’s “Some Possible Consequences of a U.S. Government Default.” As in many areas, Rothbard was a leader. Writing in the June 1992 issue of Chronicles (pp. 49–52), Rothbard made the case for “Repudiating the National Debt.” In this extended discussion, which I frequently used as a reading assignment for Principles of Macroeconomics during the 1990s, Rothbard clearly lays out the difference between public debt and private debt, as well as the moral case for public-debt repudiation or default.

First, there is no moral problem with private debt, and private debt repudiation is morally reprehensible. As Rothbard explains,

To think sensibly about the public debt, we first have to go back to first principles and consider debt in general. Put simply, a credit transaction occurs when C, the creditor, transfers a sum of money (say $1,000) to D, the debtor, in exchange for a promise that D will repay C in a year’s time the principal plus interest. If the agreed interest rate on the transaction is 10 percent, then the debtor obligates himself to pay in a year’s time $1,100 to the creditor. This repayment completes the transaction, which in contrast to a regular sale, takes place over time.

So far, it is clear that there is nothing “wrong” with private debt.

In essence: you borrowed it, you spent it, and you should be responsible for repayment.

Per Rothbard,

In a profound sense, the debtor who fails to repay the $1,100 owed to the creditor has stolen property that belongs to the creditor; we have here not simply a civil debt, but a tort, an aggression against another’s property.

What about public debt? Rothbard provides the answer:

If sanctity of contracts should rule in the world of private debt, shouldn’t they be equally as sacrosanct in public debt? Shouldn’t public debt be governed by the same principles as private? The answer is no, even though such an answer may shock the sensibilities of most people. [emphasis added]

The reason is that the two forms of debt-transaction are totally different.

Rothbard continues,

[W]hen government borrows money, it does not pledge its own money; its own resources are not liable. Government commits not its own life, fortune, and sacred honor to repay the debt, but ours. This is a horse, and a transaction, of a very different color.

How is it a different horse?

The public debt transaction, then, is very different from private debt. Instead of a low-time-preference creditor exchanging money for an IOU from a high-time-preference debtor, the government now receives money from creditors, both parties realizing that the money will be paid back not out of the pockets or the hides of the politicians and bureaucrats, but out of the looted wallets and purses of the hapless taxpayers, the subjects of the state.

Both parties [the politicians doing the borrowing and the members of the public loaning funds to the government] are immorally contracting to participate in the violation of the property rights of citizens in the future. Both parties, therefore, are making agreements about other people’s property, and both deserve the back of our hand. The public credit transaction is not a genuine contract that need be considered sacrosanct, any more than robbers parceling out their shares of loot in advance should be treated as some sort of sanctified contract.

In summary, as a taxpayer, you did not borrow the funds, you did not spend the funds, and you have no moral obligation to repay the funds.

Rothbard’s recommendation: “I propose, then, a seemingly drastic but actually far less destructive way of paying off the public debt at a single blow: outright debt repudiation.” Repudiation is not only a sound economic solution to our fiscal crisis, but it is also the morally correct solution. Rothbard’s more detailed proposal, which was a “combination of repudiation and privatization,” should be considered a blueprint for an effective debt-reduction plan. As Rothbard argued, such a plan “would go a long way to reducing the tax burden, establishing fiscal soundness, and desocializing the United States.” As an added bonus, default would be as effective, if not more effective, than a balanced budget amendment, in reducing the likelihood of a future reoccurrence of the problem.

But “[i]n order to go this route, however, we first have to rid ourselves of the fallacious mindset that conflates public and private, and that treats government debt as if it were a productive contract between two legitimate property owners.” The commentary by Hummel and Henderson are evidence that some are seriously addressing this issue, alas, after over a 20 year lag.

John P. Cochran is emeritus dean of the Business School and emeritus professor of economics at Metropolitan State University of Denver and coauthor with Fred R. Glahe of The Hayek-Keynes Debate: Lessons for Current Business Cycle Research. He is also a senior scholar for the Mises Institute and serves on the editorial board of the Quarterly Journal of Austrian Economics. Send him mail. See John P. Cochran's article archives.

You can subscribe to future articles by John P. Cochran via this RSS feed.

Back To Leeconomics.com