Monday, February 27, 2012

The Irrelevance of Worker Need and Employer Greed in Determining Wages

[This article is adapted from a section of Chapter 14, specifically pp. 613–18, of the author's Capitalism: A Treatise on Economics (Ottawa, Illinois: Jameson Books, 1996).]

The Marxian doctrine of the alleged arbitrary power of employers over wages appears plausible because there are two obvious facts that it relies on, facts which do not actually support it, but which appear to support it. These facts can be described as "worker need" and "employer greed." The average worker must work in order to live, and he must find work fairly quickly, because his savings cannot sustain him for long. And if necessary — if he had no alternative — he would be willing to work for as little as minimum physical subsistence. At the same time, self-interest makes employers, like any other buyers, prefer to pay less rather than more — to pay lower wages rather than higher wages. People put these two facts together and conclude that if employers were free, wages would be driven down by the force of the employers' self-interest — as though by a giant plunger pushing down in an empty cylinder — and that no resistance to the fall in wages would be encountered until the point of minimum subsistence was reached. At that point, it is held, workers would refuse to work because starvation without the strain of labor would be preferable to starvation with the strain of labor.

What must be realized is that while it is true that workers would be willing to work for minimum subsistence if necessary, and that self-interest makes employers prefer to pay less rather than more, both of these facts are irrelevant to the wages the workers actually have to accept in the labor market.

What must be realized is that while it is true that workers would be willing to work for minimum subsistence if necessary, and that self-interest makes employers prefer to pay less rather than more, both of these facts are irrelevant to the wages the workers actually have to accept in the labor market.

Let us start with "worker need." To understand why a worker's willingness to work for subsistence if necessary is irrelevant to the wages he actually has to work for, consider the analogous case of the owner of a late-model car who decides to accept a job offer, and to live, in the heart of New York City. If this car owner cannot afford several hundred dollars a month to pay the cost of keeping his car in a garage, and if he cannot devote several prime working hours every week to driving around, hunting for places to park his car on the street, he will be willing, if he can find no better offer, to give his car away for free — indeed, to pay someone to come and take it off his hands. Yet the fact that he is willing to do this is absolutely irrelevant to the price he actually must accept for his car. That price is determined on the basis of the utility and scarcity of used cars — by the demand for and supply of such cars. Indeed, so long as the number of used cars offered for sale remained the same, and the demand for used cars remained the same, it would not matter even if every seller of such a car were willing to give his car away for free, or willing even to pay to have it taken off his hands. None of them would have to accept a zero or negative price or any price that is significantly different from the price he presently can receive.

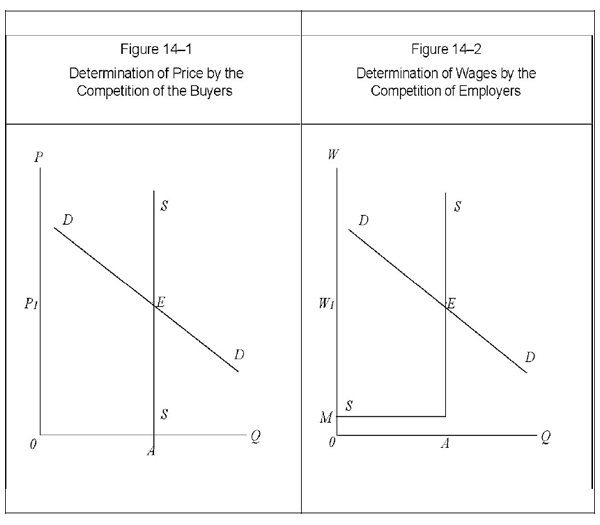

This point is illustrated in terms of the simple supply and demand diagram presented in Figure 14–1.

On the vertical axis, I depict the price of used cars, designated by P. On the horizontal axis, I depict the quantity of used cars, designated by Q, that sellers are prepared to sell and the buyers to buy at any given price. The willingness of sellers to sell some definite, given quantity of used cars at any price from zero on up (or, indeed, from less than zero by the cost of having the cars taken off their hands) is depicted by a vertical line drawn through that quantity. The vertical line SS denotes the fact that sellers are willing to sell the specific quantity A of used cars at any price from something less than zero on up to as much as they can get for their cars. The fact that they are willing to sell for zero or a negative price has nothing whatever to do with the actual price they receive, which in this case is the very positive price P1. The actual price they receive in this case is determined by the limitation of the supply of used cars, together with the demand for used cars.

In Figure 14–1, it is determined at point E, which represents the intersection of the vertical supply line with the demand curve. The price that corresponds to that juncture of supply and demand is P1. The fact that the sellers are all willing if necessary to accept a price less than P1 is, as I say, simply irrelevant to the price they actually must accept. The price the sellers receive in a case of this kind is not determined by the terms on which they are willing to sell. Rather, it is determined by the competition of the buyers for the limited supply offered for sale. (This, of course, is the kind of case Böhm-Bawerk had in mind when he declared that "price is actually limited and determined by the valuations on the part of the buyers exclusively."[1])

Essentially the same diagram, Figure 14–2, depicts the case of labor. Instead of showing price on the vertical axis, I show wages, designated by W. Instead of the supply line being vertical to the point of the sellers being willing to pay to have their good taken off their hands, I assume that no supply whatever is offered below the point of "minimum subsistence," M. This is depicted by a horizontal line drawn from M and parallel to the horizontal axis. Thus, the supply curve in this case has a horizontal portion at "minimum subsistence" before becoming vertical. These are the only differences between Figures 14–1 and 14–2.

Figure 14–2 makes clear that the fact that the workers are willing to work for as little as minimum subsistence is no more relevant to the wages they actually have to accept than was the fact in the previous example that the sellers of used cars were willing to give them away for free or pay to have them taken off their hands. For even though the workers are willing to work for as little as minimum subsistence, the wage they actually obtain in the conditions of the market is the incomparably higher wage W1, which is shown by the intersection — once again at point E — of the demand for labor with the limited supply of labor denoted by point A on the horizontal axis. Exactly like the value of used cars, or anything else that exists in a given, limited supply, the value of labor is determined on a foundation of its utility and scarcity, by demand and supply — more specifically, by the competition of buyers for the limited supply — not by any form of cost of production, least of all by any "cost of production of labor."

It also quickly becomes clear that "employer greed" is fully as irrelevant to the determination of wage rates as "worker need." This becomes apparent as soon as the case of the art auction is recalled that I presented in Chapter 6 in order to demonstrate the actual self-interest of buyers. There I assumed that there are two people at an art auction, both of whom want the same painting. One of these people, let us now call him Mr. Smith, is willing and able to bid as high as $2,000 for the painting. The other, let us now call him Mr. Jones, is willing and able to go no higher than $1,000.

Of course, Mr. Smith does not want to spend $2,000 for the painting. This figure is merely the limit of how high he will go if he has to. He would much prefer to obtain the painting for only $200, or better still, for only $20, or, best of all, for nothing at all. What we must recall here is precisely how low a bid Mr. Smith's rational self-interest allows him to persist in. Would it, for example, actually be to Mr. Smith's self-interest to persist in a bid of only $20, or $200?

It should be obvious that the answer to this question is decidedly no! This is because if Mr. Smith persists in such a low bid, the effect will be that he loses the painting to Mr. Jones, who is willing and able to bid more than $20 and more than $200. In fact, in the conditions of this case, Mr. Smith must lose the painting to the higher bidding of Mr. Jones, if he persists in bidding any sum under $1,000! If Mr. Smith is to obtain the painting, the conditions of the case require him to bid more than $1,000, because that is the sum required to exceed the maximum potential bid of Mr. Jones.

This case contains the fundamental principle that names the actual self-interest of buyers. That principle is that a buyer rationally desires to pay not the lowest price he can imagine, but the lowest price that is simultaneously too high for any other potential buyer of the good, who would otherwise obtain the good in his place.

This identical principle, of course, applies to the determination of wage rates.

The only difference between the labor market and the auction of a painting is the number of units involved. Instead of one painting with two potential buyers for it, there are many millions of workers who must sell their services, together with potential employers of all those workers and of untold millions more workers. This is because just as in the example of the art auction, the essential fact that is present in the labor market is that the potential quantity demanded exceeds the supply available. The potential quantity of labor demanded always far exceeds the quantity of labor that the workers are able, let alone willing, to perform.

For labor, it should be recalled, is scarce. It is the most fundamentally useful and scarce thing in the economic system: virtually everything else that is useful is its product and is limited in supply only by virtue of our lack of ability or willingness to expend more labor to produce a larger quantity of it. (This, of course, includes raw materials, which can always be produced in larger quantity by devoting more labor to the more intensive exploitation of land and mineral deposits that are already used in production, or by devoting labor to the exploitation of land and mineral deposits not presently exploited.) As I have shown, for all practical purposes there is no limit to our need and desire for goods or, therefore, for the performance of the labor required to produce them. In having, for example, a need and desire to be able to spend incomes five or ten times the incomes we presently spend, we have an implicit need and desire for the performance of five or ten times the labor we presently perform, for that is what would be required in the present state of technology and the productivity of labor to supply us with such increases in the supply of goods. Moreover, almost all of us would welcome the full-time personal services of at least several other people. Thus, on both grounds labor is scarce, for the maximum amount of labor available to satisfy the needs and desires of the average member of the economic system can never exceed the labor of just one person, and, indeed, in actual practice, falls far short of that amount because of the existence of large numbers of people, notably young children and elderly parents, who are incapable of performing labor and must live as dependents on the labor of others.

The consequence of the scarcity of labor is that wage rates in a free market can fall no lower than corresponds to the point of full employment. At that point the scarcity of labor is felt, and any further fall in wage rates would be against the self-interests of employers because then a labor shortage would ensue. Thus, if somehow wage rates did fall below the point corresponding to full employment, it would be to the self-interest of employers to bid them back up again.

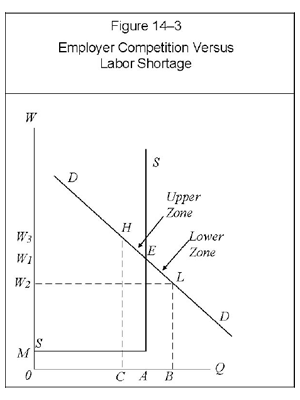

These facts can be shown in the same supply and demand diagram I used to show the irrelevance to wage determination of workers being willing to work for subsistence. Thus, Figure 14–3 shows that if wage rates were below their market equilibrium of W1, which takes place at the point of full employment, denoted by E — if, for example, they were at the lower level of W2 — a labor shortage would exist. The quantity of labor demanded at the wage rate of W2 is B. But the quantity of labor available — whose employment constitutes full employment — is the smaller amount A. Thus, at the lower wage, the quantity of labor demanded exceeds the supply available by the horizontal distance AB.

The shortage exists because the lower wage of W2 enables employers to afford labor who would not have been able to afford it at the wage of W1, or it enables employers who would have been able to afford some labor at the wage of W1 to now afford a larger quantity of labor. To whatever extent such employers employ labor that they otherwise could not have employed, that much less labor remains to be employed by other employers, who are willing and able to pay the higher wage of W1.

For the sake of simplicity, we can assume that at the artificially low wage of W2 the entire quantity AB of labor is employed by employers who otherwise could not have afforded to employ that labor. The effect of this is to leave an equivalently reduced quantity of labor available for those employers who could have afforded the market wage of W1. The labor available to those employers is reduced by AC, which is precisely equal to AB. This is the inescapable result of the existence of a given quantity of labor and some of it being taken off the market by some employers at the expense of other employers. What the one set gains, the other must lose. Thus, because the wage is W2 rather than W1, the employers who could have afforded the market wage of W1 and obtained the full quantity of labor A are now able to employ only the smaller quantity of labor C, because labor has been taken off the market by employers who depend on the artificially low wage of W2.

The employers who could have afforded the market wage of W1 are in identically the same position as the bidder at the art auction who is about to see the painting he wants go to another bidder not able or willing to pay as much. The way to think of the situation is that there are two groups of bidders for quantity AB of labor: those willing and able to pay the market wage of W1, or an even higher wage — one as high as W3 — and those willing and able to pay only a wage that is below W1 — a wage that must be as low as W2. In Figure 14–3, the position of these two groups is indicated by two zones on the demand curve: an upper zone HE and a lower zone EL. The wage of W1 is required for the employers in the upper zone to be able to outbid the employers in the lower zone.

The question is: Is it to the rational self-interest of the employers willing and able to pay a wage of W1, or higher, to lose the labor they want to other employers not able or willing to pay a wage as high as W1? The obvious answer is no. And the consequence is that if, somehow, the wage were to fall below W1, the self-interest of employers who are willing and able to pay W1 or more, and who stood to lose some of their workers if they did not do so, would lead them to bid wage rates back up to W1. The rational self-interest of employers, like the rational self-interest of any other buyers, does not lead them to pay the lowest wage (price) they can imagine, but the lowest wage that is simultaneously too high for other potential employers of the same labor who are not able or willing to pay as much and who would otherwise be enabled to employ that labor in their place.

The principle that it is against the self-interest of employers to allow wage rates to fall to the point of creating a labor shortage is illustrated by the conditions which prevail when the government imposes such a shortage by virtue of a policy of price and wage controls. In such conditions, employers actually conspire with the wage earners to evade the controls and to raise wage rates. They do so by such means as awarding artificial promotions, which allow them to pay higher wages within the framework of the wage controls.

The payment of higher wages in the face of a labor shortage is to the self-interest of employers because it is the necessary means of gaining and keeping the labor they want to employ. In overbidding the competition of other potential employers for labor, it attracts workers to come to work for them and it removes any incentive for their present workers to leave their employ. This is because it eliminates the artificial demand for labor by the employers who depend on a below-market wage in order to be able to afford labor. It is, as I say, identically the same in principle as the bidder who wants the painting at an auction raising his bid to prevent the loss of the painting to another bidder not able or willing to pay as much. The higher bid is to his self-interest because it knocks out the competition. In the conditions of a labor shortage, which necessarily materializes if wage rates go below the point corresponding to full employment, the payment of higher wages provides exactly the same benefit to employers.

On the basis of the preceding discussion, it should be clear that average money wage rates are determined neither by worker need nor by employer greed, but, basically, by the quantity of money in the economic system and thus the aggregate monetary demand for labor, on the one side, and by the number of workers willing and able to work, on the other — that is, by the ratio of the demand for labor to the supply of labor. It should also be clear that in a free labor market, money wage rates can fall no lower than corresponds to the point of full employment.

Two points should be realized in connection with the principle that it is against the self-interest of employers to allow wage rates to fall below the point that corresponds to full employment. First, the operation of the principle does not require that full employment be established throughout the economic system before wage rates cease to fall. On the contrary, the principle applies to each occupation and, still more narrowly, to each occupation within each geographical area. For example, the wage rates of carpenters in Des Moines can fall no further than corresponds to the point of full employment of carpenters in Des Moines. Any further fall would create a shortage of such carpenters and thus would be prevented or quickly reversed, even though there might still be major unemployment in other occupations or in other geographical areas.

Second, the operation of the principle need not be feared as possibly serving to bring about the establishment of subsistence wages through the back door, so to speak. By this, I mean that so long as unemployment exists, there is room for wage rates to fall without the creation of a labor shortage. And in a free market, wage rates would in fact fall in such circumstances. This is because in such circumstances, the self-interest of the employers, and also of the unemployed, would operate to drive them down. It should not be thought, however, that the fall in wage rates in these circumstances meant that the conditions of supply and demand were capable of accomplishing the human misery that Marxism attributes to the alleged arbitrary power of businessmen and capitalists.

It should be recalled that we saw in Chapter 13 that a drop in wage rates to the full employment point does not imply any drop in the average worker's standard of living. That is, it does not imply any reduction in the goods and services he can actually buy — any reduction in his so called real wages — because the elimination of unemployment that the fall in wage rates brings about means more production and a fall in costs of production, both of which mean lower prices. Indeed, we saw that it is likely that real wages actually rise with the elimination of unemployment, even in the short run, because not only do prices fall as much as, or even more than, wages, but also the burden of supporting the unemployed is eliminated, with the result that disposable, take-home pay drops less than gross wages and less than prices. When these facts are kept in mind, it is clear that insofar as market conditions require a fall in wage rates, they are, if anything, at the same time operating to raise the average worker's standard of living further above subsistence, not drive it down toward subsistence.

Copyright © 2012 by George Reisman.

George Reisman, Ph.D., is Pepperdine University Professor Emeritus of Economics, Senior Fellow at the Goldwater Institute, and the author of Capitalism: A Treatise on Economics (Ottawa, Illinois: Jameson Books, 1996). His web site is www.capitalism.net. His blog is at georgereismansblog.blogspot.com. Send him mail. (A PDF replica of the complete book Capitalism: A Treatise on Economics![]() can be downloaded to the reader's hard drive simply by clicking on the book's title, immediately preceding, and then saving the file when it appears on the screen.) See George Reisman's article archives.

can be downloaded to the reader's hard drive simply by clicking on the book's title, immediately preceding, and then saving the file when it appears on the screen.) See George Reisman's article archives.

Notes

[1] See Eugen von Böhm-Bawerk, Capital and Interest, 3 vols., trans. George D. Huncke and Hans F. Sennholz (South Holland, Ill.: Libertarian Press, 1959), 2:245.

Back To Leeconomics.com